A real estate “Closing” is where you and I meet with some or all of the following individuals: the Seller, the Seller’s agent, a representative from the lending institution and a representative from the title company, in order to transfer the property title to you. The purchase agreement or contract you signed describes the property, states the purchase price and terms, sets forth the method of payment, and usually names the date and place where the closing or actual transfer of the property title and keys will occur.

If financing the property, your lender will require you to sign a document, usually a promissory note, as evidence that you are personally responsible for repaying the loan. You will also sign a mortgage or deed of trust on the property as security to the lender for the loan. The mortgage or deed of trust gives the lender the right to sell the property if you fail to make the payments. Before you exchange these papers, the property may be surveyed, appraised, or inspected, and the ownership of title will be checked in county and court records.

About a week in advance, I will schedule the real estate Closing with you and the title company. We will meet at the title company on the day of closing, sit in a conference room with an escrow officer (who is also a notary), and you will sign the legal documents to purchase the home.

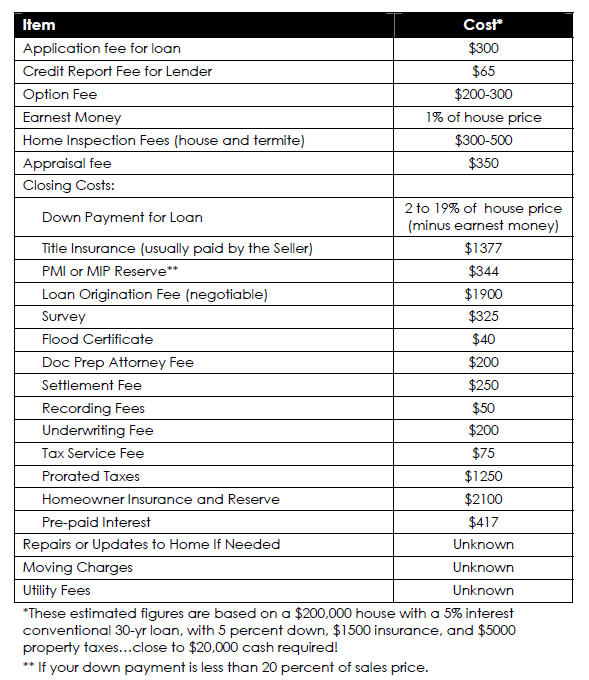

You will need to bring your driver’s license with you to the real estate Closing. At closing, you will be required to pay all fees and closing costs in the form of “guaranteed funds” such as a cashier’s check. Your agent or escrow officer will notify you of the exact amount at the day before Closing.

Buyers: What To Bring to Your Closing Appointment

Here’s the minimum of what to bring to your “Closing”:

- Photo ID

- “Good funds” for your down payment and other costs: typically

a cashier’s check—never cash