Items Needed To Apply for a Home Loan

Applying for a home loan these days is not for the “weak at heart”! It is a pain-in-the-neck process no matter how much money you have or which lender you choose. So mentally prepare yourself for a hassle, and you won’t be disappointed. ;-D

Applying for a home loan these days is not for the “weak at heart”! It is a pain-in-the-neck process no matter how much money you have or which lender you choose. So mentally prepare yourself for a hassle, and you won’t be disappointed. ;-D

NOTE: Read The Perfect Loan File on Forbes for details.

There is a lot of paperwork required in order to obtain a home loan. Plus, you will have to provide much of the paperwork multiple times throughout the loan process because of new lending standards (Dodd-Frank Wall Street Reform and Consumer Protection Act legislation and the Patriot Act).

Lenders are now required to verify certain items several times through the process…so please don’t get offended or frustrated when they ask you for something that you have already provided them.

Here’s what you will probably need to apply for a home loan (aka, mortgage):

- Proof of identity for borrowers including driver’s license and Social Security number.

- Address history for three years.

- Copy of tax returns for past 2 years.

- Banks names and numbers for all checking and savings accounts.

- Bank statements for the past 3 months.

- Documentation of all income including pay stubs for past 2 months.

- Proof of bonuses for 2 years if applicable.

- W-2 forms showing income for past 2 years.

- Job history for past 2 years.

- Net worth sheet with list of all assets and liabilities including account numbers.

- Most recent 401K statements and other retirement accounts.

- Copy of gift letter if applicable.

- If self-employed, copy of balance sheet.

- Divorce decrees if divorced in the past 2 years.

- Proof of residency, if applicable.

- College transcript if you were a student in the past 2 years.

- Bankruptcy discharge papers, if applicable.

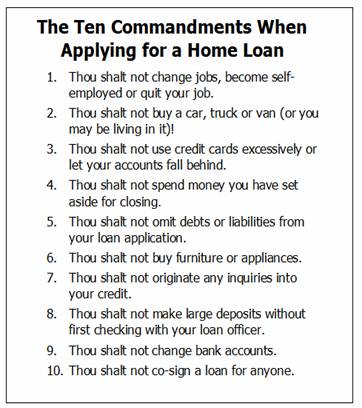

What Not To Do

Maybe you’ve just gotten married. Maybe you got a raise … or maybe you’re just plain sick of renting. Whatever the case, you’ve decided that it’s time to buy a house. You’ll be given all kinds of advice and pointers about what you should do and how you should do it, but there are things you shouldn’t do that are equally important.

Don’t be deceptive or dishonest when you’re filling out your loan application. Even if you get away with fudging the numbers a little to secure a higher loan (which is loan fraud), what’s the payoff you’re looking for? A monthly payment that you can’t truly afford?

Avoid moving your money around. To eliminate potential fraud and provide a degree of quality control, a lender will review the source of funds for your down payment and closing costs. Most likely, you will be asked to provide recent statements for any of your liquid assets. This includes checking accounts, savings accounts, money market funds, certificates of deposit, stocks, mutual funds, and even your 401K and retirement accounts. If you have been moving money between accounts during that time, there may be large deposits and withdrawals in some of them, which could make it more difficult for the lender to document properly.

Once you’ve been approved for a certain amount, resist the temptation to make any big purchases that could affect your ability to service the loan. Examples might be a new car, a boat, or expensive furnishings.

Sure you may be able to afford the mortgage and a car payment, but what if an unexpected expense comes along that causes your monthly budget to become unbalanced—you’ve got a shiny new car, but you may have trouble affording that and gasoline, and the mortgage, and the utilities. You’re caught in a situation where you’ve over-extended yourself. Even if you’re able to make it work on a month-to-month basis, you may have trouble putting money to your savings account.

Sometimes, knowing what not to do is just as important as knowing what to do.

Big Bank vs. Local Lender

A “big bank” is Chase, Bank of America, Wells Fargo, etc. They may be great banks but, that doesn’t necessarily mean they are great mortgage lenders.

Check your loan officer at https://www.nmlsconsumeraccess.org.

To be fair, I have seen a handful of deals, with big bank lenders, that went very well. However, several of them were for employees of the bank…who had the inside advantage.

Lenders to Consider

Lenders (loan officers) that my clients have used in the past:

Will Swallen

Bay Equity

713.558.0364

www.LoanWithWill.com

David Krichmar

DaveYourMortgageGuy.com

832-689-6012

Deesh Nair

Motto Mortgage

Deesh.Nair@mottomortgage.com

914-844-7797